The ICAO pointed out that the impacts on the airline industry were expected to be “greater than those caused by the 2003 SARS epidemic,” citing the higher volume and greater global extent of the flight cancellations being seen.

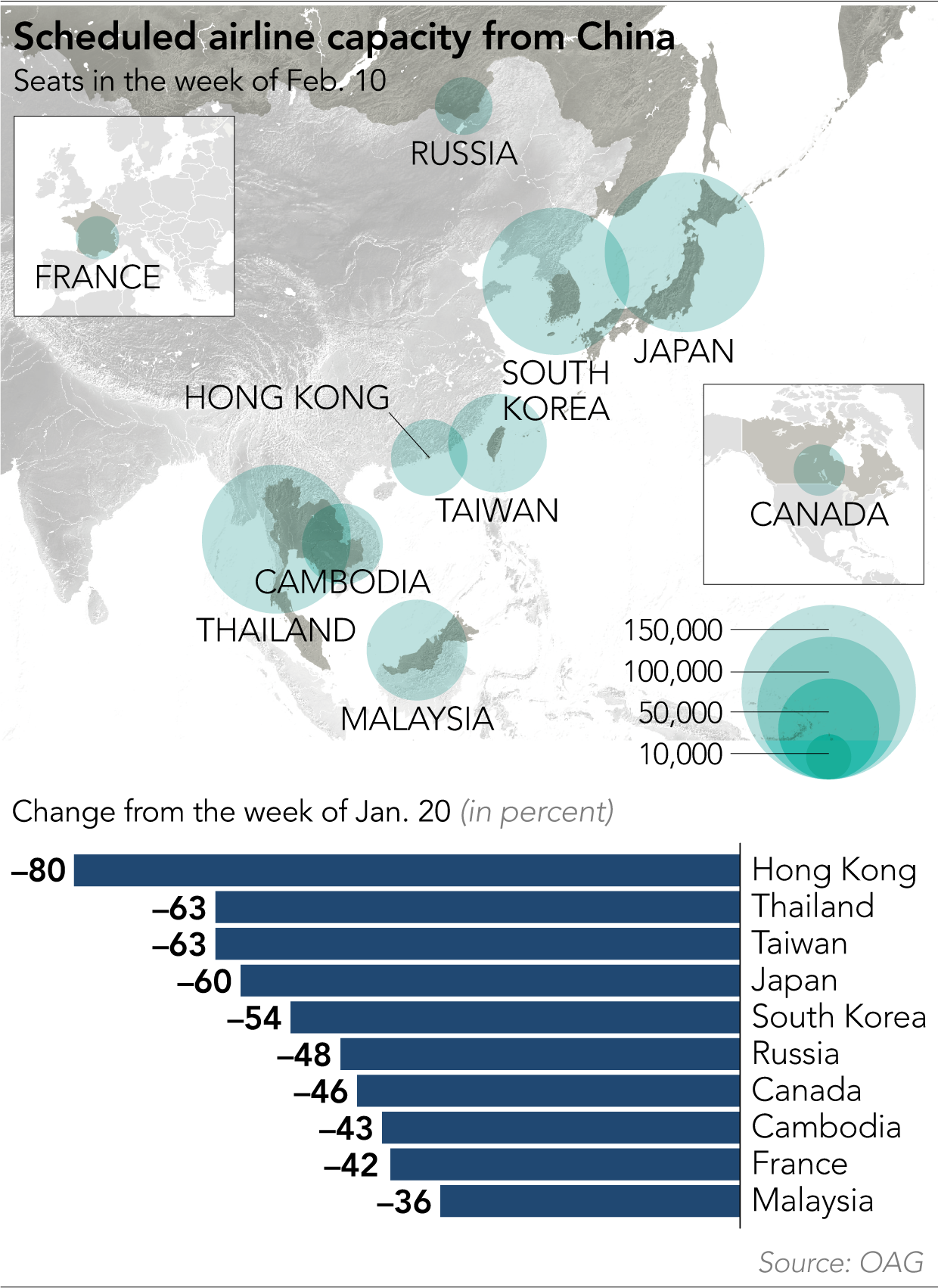

Flight data show a significant reduction in the capacity in airlines’ China routes. According to airline data provider OAG, the number of seats operated from China in the week beginning on Feb. 10 fell by some 1.4 million seats, or nearly 70%, from three weeks earlier.

On Friday, Singapore Airlines said that the growing scale of the virus outbreak posed “significant challenges” to the group, after reporting a 11% rise in net profit for the October-December period.

The city-state’s flag carrier has reduced capacity for Chinese routes and its budget subsidiary Scoot has suspended all China flights. “Demand for services to mainland China has been severely affected,” the company said, adding that it would make appropriate network adjustments and manage costs tightly.

Other airlines are also starting to gauge the impact of the disease on their earnings. Vietnam Airlines said Thursday it was losing up to 250 billion Vietnamese dong ($10.7 million) per week in revenue, according to a Reuters report.

The infectious disease, now officially named COVID-19, has killed more than 1,700 people in China and a few overseas, with more than 70,000 infection cases having been reported globally.

As the disease spread from the city of Wuhan, the epicenter, to the rest of China and beyond borders, China banned outbound group tours, while many other countries have advised their citizens to refrain from traveling to China. This has dampened what would normally be huge demand for travel in the recent weeks amid the Chinese New Year holiday.

In tandem with those measures by governments, a growing number of airlines — from British Airways to United Airlines to Indonesia’s Lion Air — have canceled all China routes. Apart from the 70 companies that canceled all China flights, there are some 50 airlines that have reduced capacity for China routes, the ICAO said.

As the country is the largest source of international tourists, China routes are among the most important for many airlines. Before the coronavirus outbreak, airlines had planned a 9% increase in capacity on flights to and from China for the first quarter of 2020 compared with 2019, according to the ICAO.

But the ICAO estimates that the January-March quarter has instead seen a reduction of between 16.4 and 19.6 million passengers compared to what airlines had projected. “This equates to a potential reduction of $4 billion to $5 billion in gross operating revenues for airlines worldwide,” the agency said.

Airlines have therefore begun to make cost-cutting measures. On Friday, South Korea’s Asiana Airlines confirmed that it was asking cabin crew members to take unpaid leave, following Hong Kong’s Cathay Pacific Airways, which has asked its all 27,000 employees to take up to three weeks of unpaid leave.

Hong Kong Airlines will also cut 400 jobs, or about 10% of its workforce. Elsewhere, more airlines are expected to implement cost-cutting measures if the situation continues.

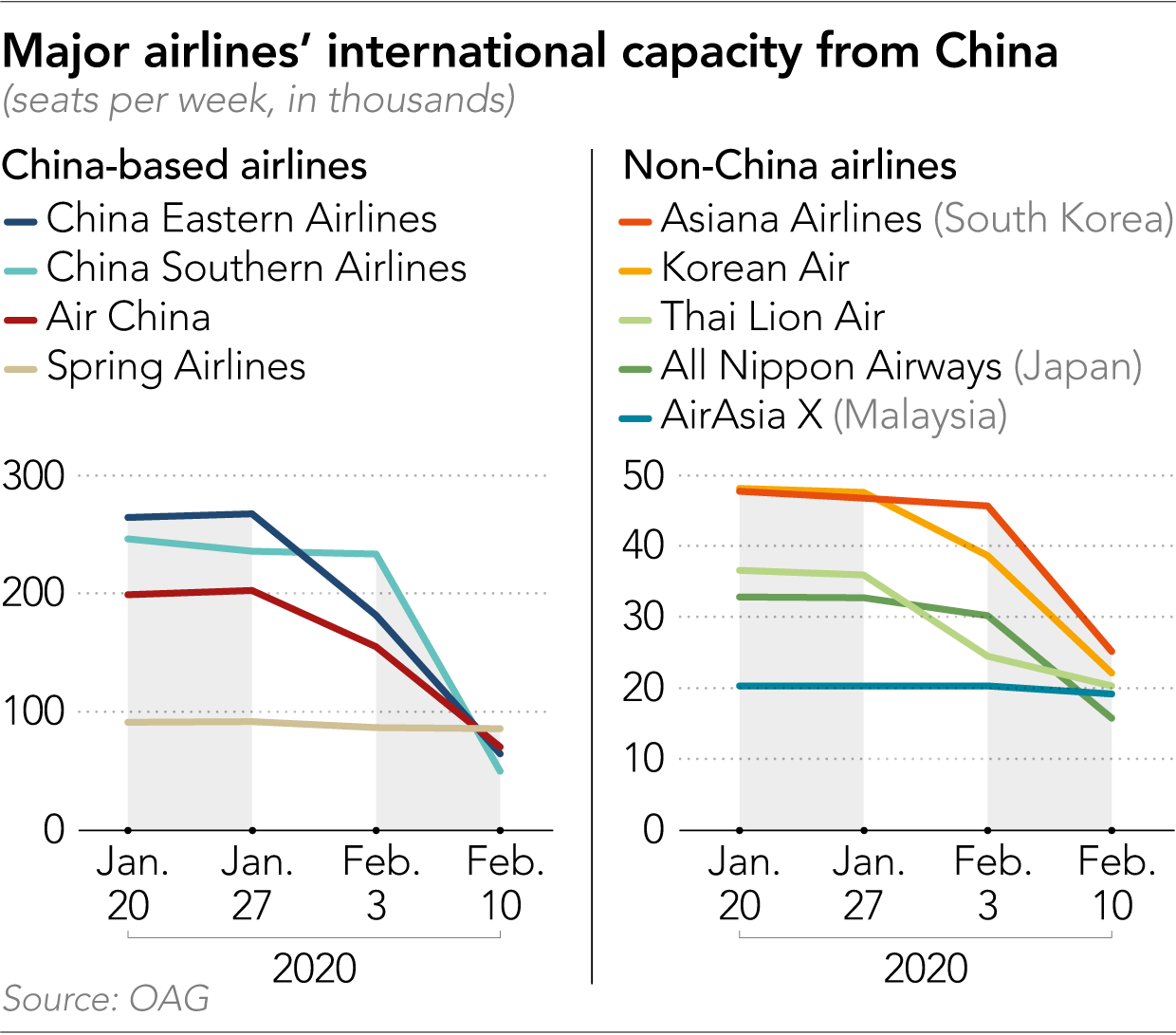

According to OAG, capacity reduction so far this year has mainly come from China’s biggest carriers, with China Southern Airlines seeing a 80% drop from about 246,000 to 50,000 seats during the period, while China Eastern Airlines has seen a 75% drop from 264,000 to 65,000 seats.

Non-Chinese carriers have also seen their capacity halved, with Korean Air Lines dropping 54%, Asiana 47%, Thai AirAsia 49%, and Japan’s All Nippon Airways 52%.

Overall, capacity of international flights from China to Japan and Thailand dropped 60% and 63%, respectively, with South Korea seeing a 54% drop, Russia 48% and France 42%.

Cre: Nikkei Asian Review

Nguyen Mai Huong-COMM