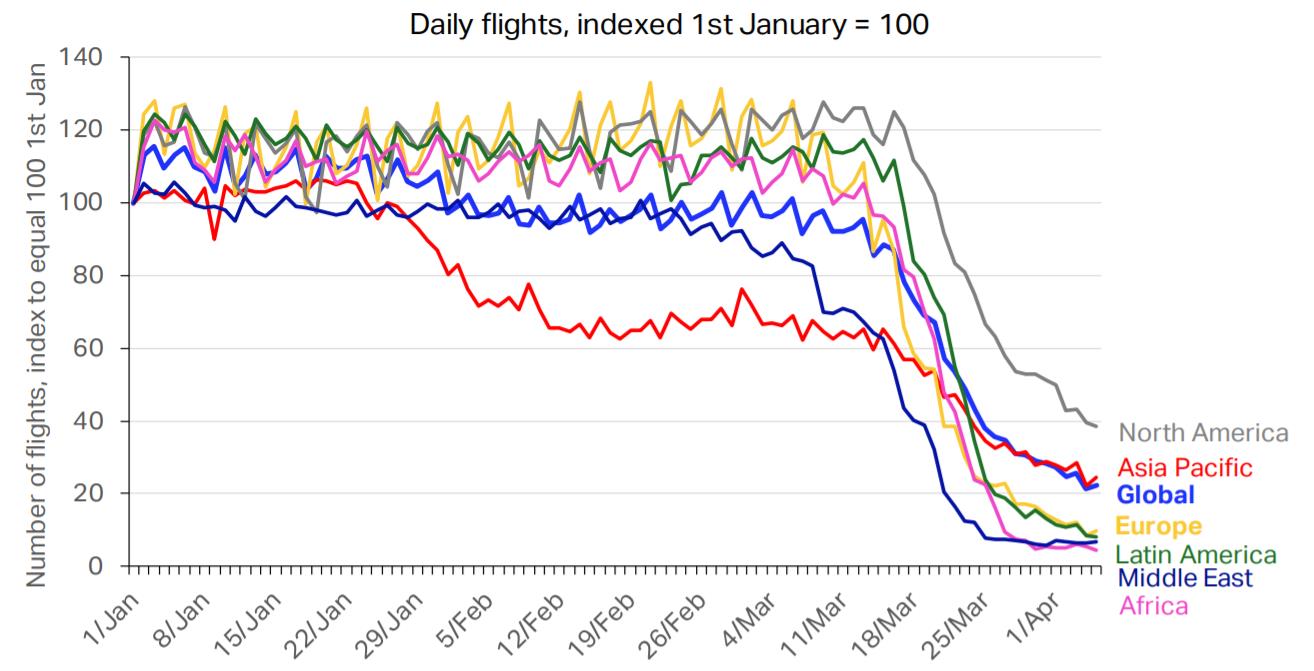

Based on a 65% fall in worldwide flights in March, economic recession forecasts at the time, and a relaxation of travel restrictions through H2.

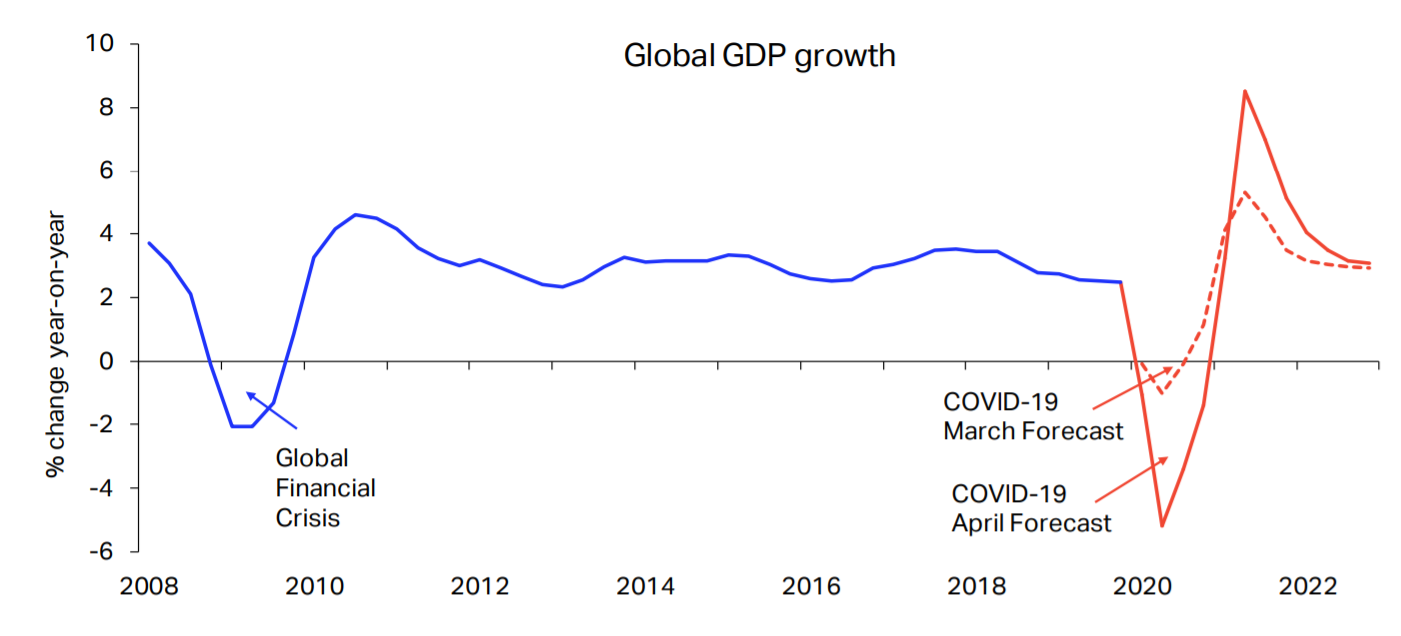

Worldwide flights now down almost 80% by early April. Recession now expected to be much deeper in 2020 Economists’ revised forecasts expect output loss twice as large as GFC.

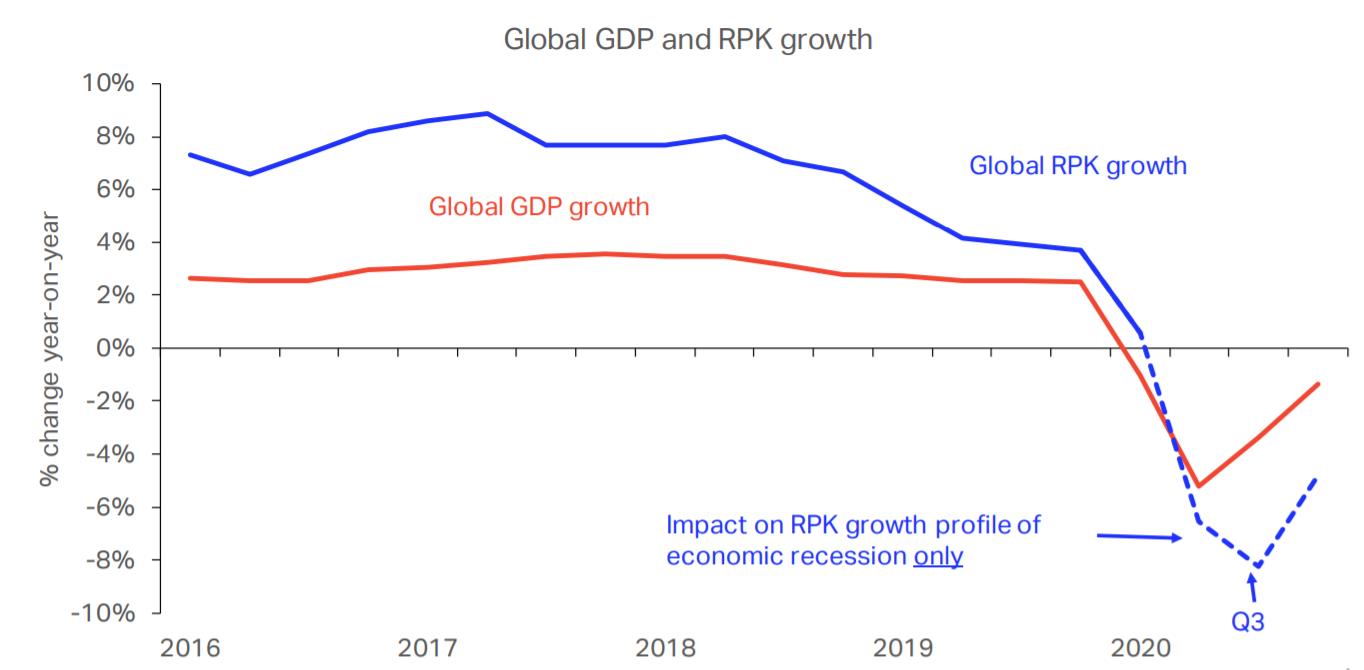

Recession now expected to be much deeper in 2020. Economists’ revised forecasts expect output loss twice as large as GFC.

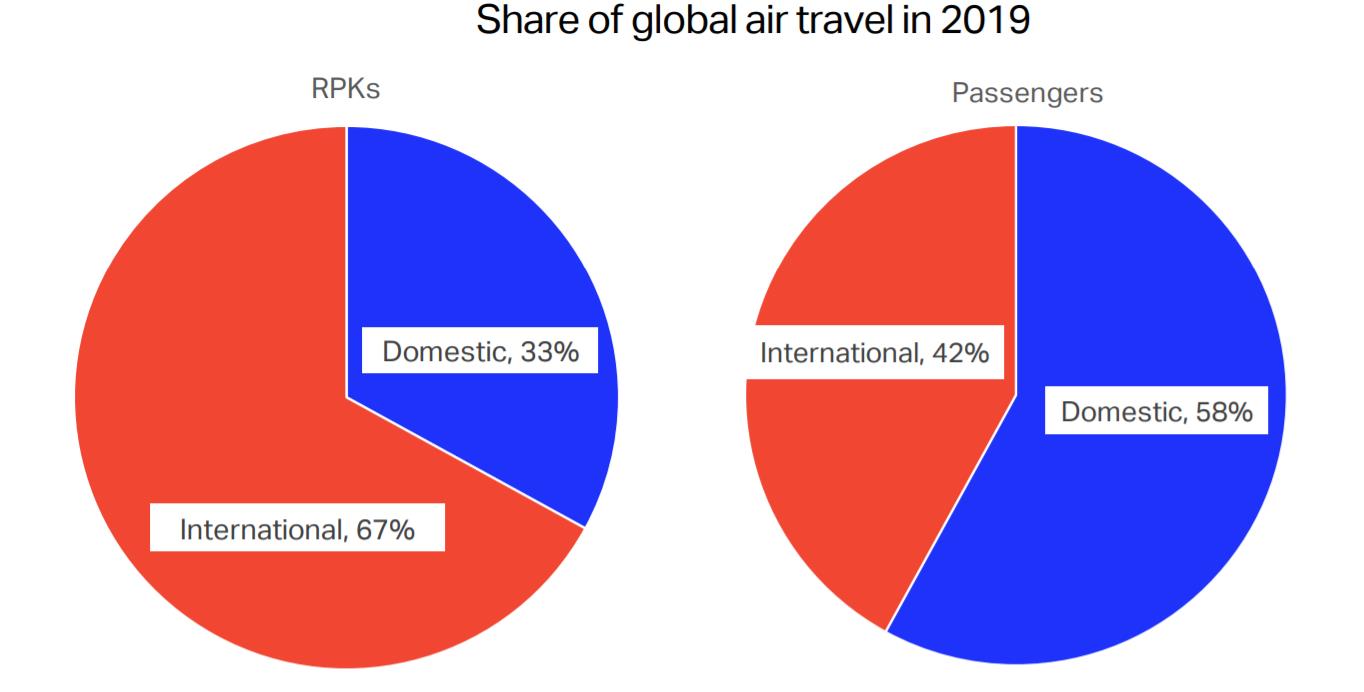

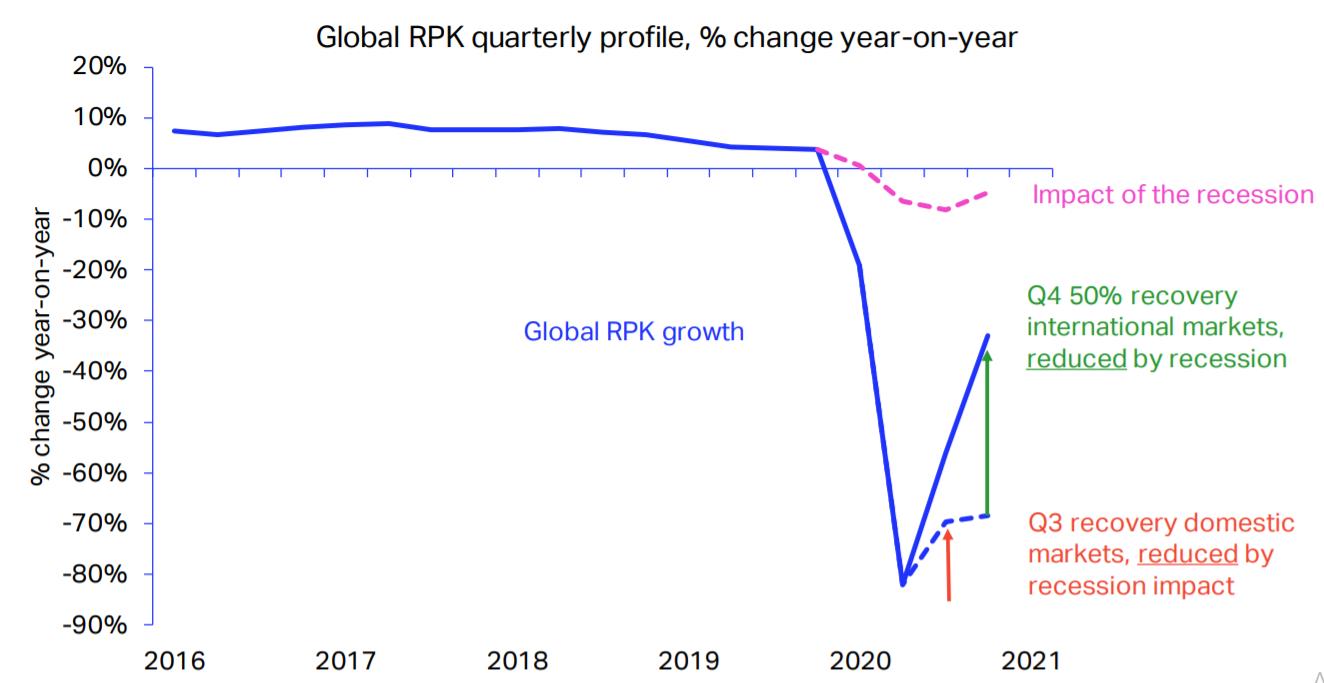

Post lock-down return to air travel likely to be in stages. We assume domestic markets open in Q3 but international slower to open Share of global air travel in 2019.

Recession alone would push global RPKs down 8% in Q3. This excludes the travel restrictions and confidence effects of COVID-192020.

H2 ‘restart’ slow leaving RPKs down 33% yoy. By Q4 Domestic markets assumed to open in Q3, international much slower.

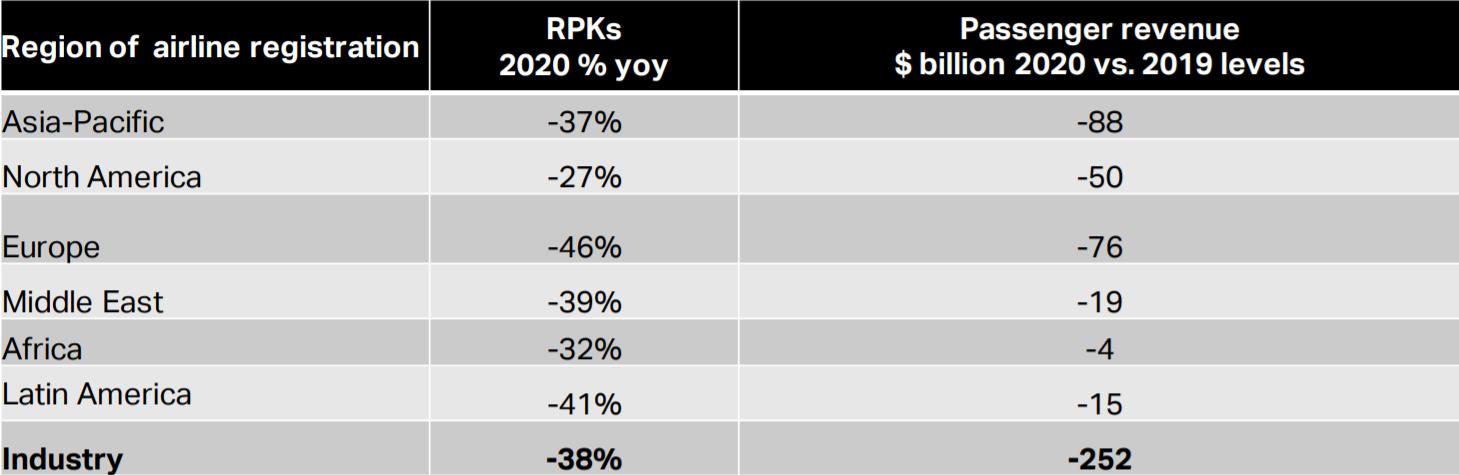

That implies a halving of global RPKs in 2020. With lower yields that means a $314 billion or 55% fall in passenger revenues.

Note: This assumes, as in the previous impact assessment, that the domestic lock-down lasts 3 months, until the end of Q2. But international travel restrictions are assumed in this assessment to be reduced more slowly, with only 50% of pent-up international RPKs recovered by Q4 (after reduction due to recession impact).

Source: IATA

Nguyen Xuan Nghia – COMM