1. Norwegian Air: 2.8 years

Norwegian has a very young fleet of 787-9 jets (Cre: Sunday Post).

Norwegian has a very young fleet of 787-9 jets (Cre: Sunday Post).

Firstly, taking the top spot is European budget airline Norwegian. Some of their Boeing 787s are less than a year old and the rest are mostly 1-3 years old. We used the average of Norwegian’s six legal entities as the company is registered as separate airlines in Argentina, Ireland, Norway, Sweden, the United Kingdom and of course, Norway. Unfortunately, the numbers include 18 grounded 737 MAX aircraft.

2. Vistara: 2.8 years

Vistara is partly owned by Tata, along with Singapore Airlines (Cre: Vistara Group).

Vistara is partly owned by Tata, along with Singapore Airlines (Cre: Vistara Group).

Secondly, we have a considerably smaller airline: Vistara. The Indian full-service carrier is made up of an all-Airbus A320 fleet. The company is backed by Indian conglomerate Tata Sons and Singapore Airlines. Their oldest aircraft are five year old “CEO” variants and the newest being a one year old NEO.

3. FlyDubai: 4.2 years

Flydubai is the second-largest Boeing 737 MAX customer (Cre: Eturbonews).

Flydubai is the second-largest Boeing 737 MAX customer (Cre: Eturbonews).

Operating out of Dubai in the United Arab Emirates, this budget airline has a fleet of 59 aircraft. An all-Boeing 737 airline, the fleet is a mix of NG and MAX variants. That might change…

4. Aeroflot: 4.4 years

Aeroflot’s fleet includes the Sukhoi Superjet 100 (Cre: Airbus).

Aeroflot’s fleet includes the Sukhoi Superjet 100 (Cre: Airbus).

Aeroflot operates a mix of aircraft – ranging from Airbus A320s and A330s to the Boeing 777 and Sukhoi Superjet. One of the larger airlines on our list, Aeroflot’s list of active aircraft numbers 250.

5. Hong Kong Express: 4.4 years

An HK Express A321 (Cre: Branding in Asia Magazine).

A much, much smaller fleet than Aeroflot, Hong Kong Express operates 24 Airbus A320s (13) and A321s (11). The budget carrier uses Hong Kong International Airport as its main hub. The airline was recently acquired by Hong Kong giant Cathay Pacific.

6. Ethiopian: 5.7 years

Ethiopian is Africa’s most reliable airline (Cre: Aircraft Interiors International).

Ethiopian is Africa’s most reliable airline (Cre: Aircraft Interiors International).

Ethiopian’s fleet of over 100 aircraft consists of mainly Boeing jets. However, this is changing as the airline takes delivery of its brand new Airbus A350s – which have an average age of only 1.6 years. The airline also operates a small fleet of 19 Dash 8s for their regional services.

7. China Eastern: 5.9 years

China Eastern will operate a daily A350 service to Vancouver (Cre: Business Insider).

China Eastern has a massive fleet of 515 aircraft. It operates a mix of narrowbody and widebody Airbus and Boeing jets including their absolutely brand new Airbus A350s and 787 Dreamliners. In fact, the largest parts of their fleet are their narrowbodies, with 199 Airbus A320s and 126 Boeing 737 NGs/MAX aircraft. Again, their new but unused MAX aircraft skew the numbers.

8. IndiGo: 5.9 years

The airline only flies A320 family aircraft (Cre: Condé Nast Traveller India).

IndiGo is a discount Indian carrier that operates domestic services throughout the country with several international destinations as well. With a total fleet size of 221, IndiGo operates 205 Airbus A320 jets. It also has a small fleet of ATR 42/72 aircraft.

9. Qatar Airways: 6 years

Qatar just recently started service from Doha to Portugal, flown by a Boeing 787-8 Dreamliner (Cre: Business Insider Singapore).

Qatar has a fleet of 225 aircraft. Their highly mixed fleet ranges from their new Airbus A350s and new(ish) Boeing 787s to their older superjumbo A380s.

10. Emirates: 6.2 years

Emirates will fly a from Dubai to Mexico City using a Boeing 777-200 (Cre: Emirates).

Emirates has a fleet of 267 aircraft including a single A319 for executive services. Other than that though, the airline has only two main types of planes: The Boeing 777 (157) and Airbus A380 (109). Although the airline has large orders of A330neos, A350s, and 787s coming in future years.

We had also originally listed Rwandair in the top 10 but with its small fleet of 12 and its limited reach, we took them out.

11. VNA: 6.3 years

VNA will have three 787-10s this year (Cre: Boeing).

VNA will have three 787-10s this year (Cre: Boeing).

In the second half of 2019, VNA plans to push for organizational restructuring. The carrier expects to complete its 20 narrow-body Airbus A321neo fleet, take delivery and operate the first 3 wide-body Boeing 787-10s out of an order book of 8 aircrafts and finalize the investment plan of 50 narrow-body aircrafts for the 2021-2025 period.

12. Air China: 6.7

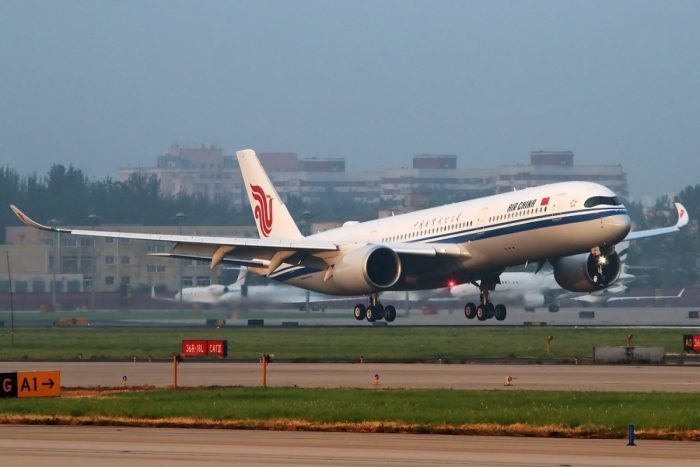

Air China boost A350 order (Cre: Facebook/Air China).

Recently, Air China has announced plans to buy a further 20 A350-900s from Airbus, in an order valued at more than $6.5bn at list prices. The order will take Air China’s commitment for the A350 to 30 planes in total.

Special mention

As we mention below, there are numerous factors that really skew the numbers. We thought we should mention a few other airlines (and their average ages) that didn’t make the “Top 12”:

Hong Kong Airlines: 6.7

Turkish: 6.8

Conclusion

Of course, this list is always in flux with older aircraft being retired and new aircraft being delivered. Fleet size is also something to consider as well as the proportion of aircraft being used for cargo service.

Finally, as we made mention of above, this list in 2019 is made even more complicated with the grounding of the 737 MAX – lowering the average age of a fleet without actually being used at the moment. Are you surprised by the results? Did your favorite airline make the list?

Cre: Simple flying

Nguyen Mai Huong-COMM