An inverview with Mr. Duong Tri Thanh, CEO of Vietnam Airlines.

An inverview with Mr. Duong Tri Thanh, CEO of Vietnam Airlines.

Vietnam Airlines plans to list its shares on the Ho Chi Minh City Stock Exchange in the first quarter of 2019, raising the state-owned carrier’s profile and positioning it to fund development of its fleet as it faces growing competition from low-cost carriers.

“Vietnam Airlines will go public in the first quarter of next year,” Duong Tri Thanh, VNA’s chief executive, said. “We are making our target the first quarter of next year, and I think this is feasible.”

Mr Thanh said that “the airline and the management want to do this”, but added that the final decision would be made by the Vietnamese government.

The airline would become one of the largest listed companies on the exchange at a time when foreign funds are looking for ways to invest in Vietnam’s fast-growing economy, including its rapidly expanding local and international tourism market.

VNA’s shares already trade hands on Hanoi’s Unlisted Public Company Market for unlisted companies at a price that values the company at more than $2bn. The Vietnamese state currently controls about 86 per cent of VNA, and said it would reduce this to 51 per cent by 2020, in a move that would free up more shares for private investors.

ANA Holdings, owner of Japan’s All Nippon Airways, bought an 8.8 per cent stake in Vietnam Airlines for $108m and entered into a code-sharing partnership in 2016. VNA said it was in the process of issuing 191m shares to existing shareholders, raising the total to 1.4bn shares in a process it said it expected to complete in December.

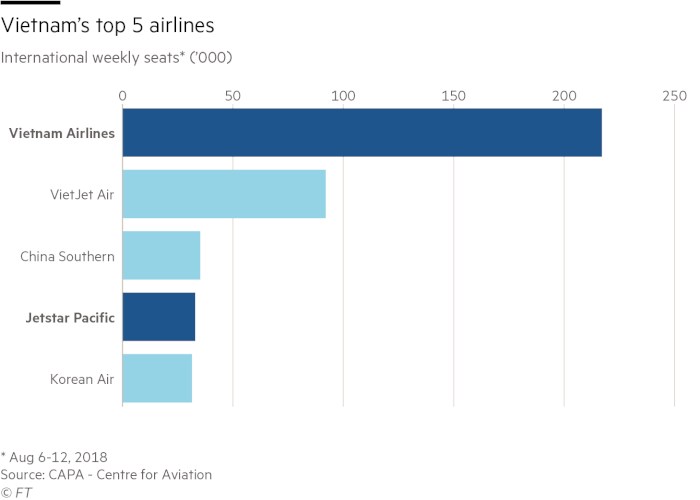

Vietnam’s national airline is the country’s largest by passengers carried, and operates the low-cost carrier Jetstar Pacific, a joint venture with Australia’s Qantas. Mr Thanh said that Jetstar Pacific, which has struggled to make a profit since its launch in 1991, was on track to do so in 2018. VNA earned a pre-tax profit of $82m in the first half of this year.

VNA has seen competitors, led by upstart VietJet Air, eat away at its market share. The newest entrant is Bamboo Airways, owned by Vietnamese property and hospitality group FLC, which is due to begin flying by year-end. Foreign low-cost carriers including AirAsia and Lion Air are growing competitors too, and VNA has responded by adding more flights to and from second-tier cities in Vietnam and overseas.

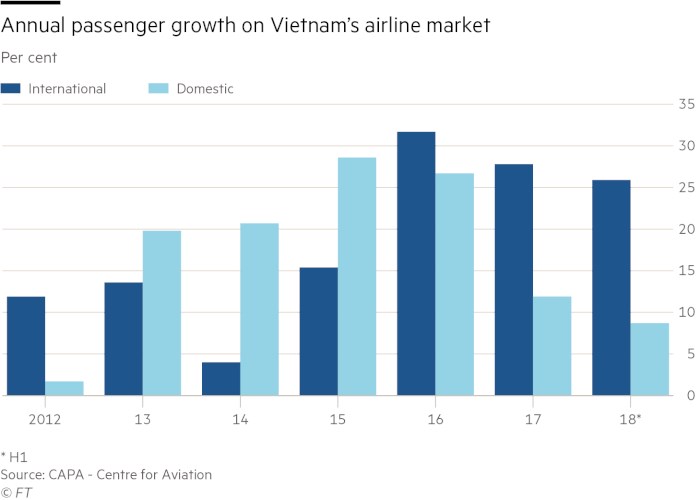

According to the CAPA Centre for Aviation, a Sydney consultancy, Vietnam’s international aviation market, driven by tourism growth, has been growing at more than 30 per cent a year. The route between Ho Chi Minh City, Vietnam’s business hub and Hanoi, the capital, is the world’s fifth-busiest.

However, the airline industry faces constraints to growth, including congestion at Ho Chi Minh City, where Vietnam is spending $16bn on a new international airport.

Vietnam’s communist government is selling down stakes in state-owned enterprises in a bid to raise funds and boost the private sector’s role in the economy.

“This would be a major Vietnamese company joining the stock exchange, which would have interest for international investors and would potentially enable Vietnam Airlines to raise funds more easily to compete with the likes of VietJet and Bamboo,” said Tony Foster, partner with the law firm Freshfields in Hanoi.

Fund managers said that the potential listing of VNA shares would raise the company’s profile among overseas institutional investors.

“VietJet has shown that in a high-growth market, airline shares are quite sexy,” said Fiachra MacCana, head of research with Ho Chi Minh City Securities. “As Vietnam Airlines becomes more commercial to win back market share, there’s no reason why their numbers shouldn’t improve dramatically.”

John Reed – Financial Times