Readying to define the future, mobile phone manufacturers are introducing 5G devices. But are the skies prepared for passengers carrying 5G smartphones?

Philippe Combe, a product manager specializing in mobile for SITAONAIR, tells Runway Girl Network that the company will consider 5G as an extension of its existing inflight mobile connectivity services, noting that the emphasis will be on ensuring seamless connections.

SITAOnAir is a company that enables airline passengers to use their mobile phones and laptops for calls, text messaging, emails and Internet browsing. By May 2014, SITAOnAir’s services were available in over 60 countries and used by 22 airlines flying over five continents.

The company is a fully owned subsidiary of SITA, originally incorporated as OnAir as a joint venture with Airbus in February 2005. In February 2013, Airbus sold its 33% final stake to SITA.[2] The company is headquartered in Geneva, Switzerland, and has operations in Seattle and sales offices in London, Singapore and Dubai.

“As a customer, on the ground, whether you are on 3G or 4G or 5G, your mobile can connect automatically to any network. This is seamless, frictionless. This is what we try to replicate within the aircraft. The experience on the ground should be the same on the aircraft,” says Combe.

He believes the challenge for airlines will be as much about setting up the right business model as it will be about having 5G-capable inflight mobile connectivity hardware. “We are in partnership with mobile operators in order to monetize the services and create adoption to have a simple way to access the services; and also all of the billing is done as you are using the phone today.”

SITAOnAir is a company that enables airline passengers to use their mobile phones and laptops.

SITAOnAir is a company that enables airline passengers to use their mobile phones and laptops.

SITAONAIR is laying the foundation for these revenue models through partnerships with mobile network providers. Its partnership with Etisalat includes a plan to extend 5G services for customers in the future.

Combe says SITAONAIR’s studies find that passengers would prefer to connect directly with their network providers, where the service is available. He notes that inflight cellular technologies “are quite popular” where permitted.

Inflight cellular is still prohibited in the US due to voice call concerns (which, from a purely technical standpoint, could be addressed with the flip of a switch.) But while Combe believes US policy might change in thhe future, he says the global market demand is enough to justify SITAONAIR’s investment in preparing for 5G network connections.

Ensuring a seamless transition regardless of network type is the best way to protect airline investment over the next two decades, he tells RGN. “We are already working on new solutions to enable cellular network on board aircraft, that is 3G, 4G and 5G. We want to provide equipment on the aircraft that can support existing technology and also coming technology.”

Though Combe could not reveal the nature of the solutions yet, and could not confirm a timeline for deployment, he says that an announcement will be forthcoming. “We are investigating closely, developing a new system in order to fit with some solutions on board aircraft, and we’re already providing systems that provide 3G technology. We already have some hardware that is working. Mobile is not something new for us. We already operate about 600 aircraft with over 20 airlines. We will continue the innovation and working closely with different partners.”

But 5G on the ground will have to come first. Combe points out that ground technology will always be more advanced than in-flight, but, as they do on the ground, passengers may put less importance on the type of connection that supports their activities, so long as the service is useful and uninterrupted.

Are the skies prepared for passengers carrying 5G smartphones?

Are the skies prepared for passengers carrying 5G smartphones?

“What we are seeing is that there are some core applications that people use on the ground which are used in-flight, like messaging, browsing or applications that require bandwidth, but not bandwidth for streaming movies; that’s not really relevant in the aircraft especially when you have IFE systems,” he says, in a statement that the likes of Viasat and some Netflix-streaming passengers would surely dispute.

The biggest change in a 5G-enabled world will be the demand to keep up with IoT and connect more devices, as these devices “will need multiple connections”, notes Combe. “This is where 5G and 4G are designed for – not only speed but the ability to connect many people at once.”

Combe sees 5G technology advancing rapidly on the ground, which will help expedite development of aircraft and operational services. “I’ve been following the rollout of 3G and 4G, and it took much more time compared to 5G. Already, the network operators have announced the investments in network and services to do that – and we are talking about trillion-dollar investments. The industry will move fast.”

Critical mass of 5G adoption on the ground is not far-off, and it’s time for airlines and their suppliers to start having these discussions. “In markets like the US or Japan, particularly, almost half of the population will be equipped with 5G devices by 2025 – that’s more than critical mass,” says the SITAONAIR executive. “It’s tomorrow.”

Panasonic’s AeroMobile is also closely tracking progress on 5G and planning for deployment, including via a partnership with Ericsson. Tempering expectations, AeroMobile CEO Kevin Rogers tells RGN, “Passengers will come to expect 5G speeds in the air, but that will take some time.”

Like Combe, however, Rogers believes that the groundwork needs to be laid. “It is important that considerations about system design and architecture start now,” he says.

Panasonic’s AeroMobile is also closely tracking progress on 5G and planning for deployment.

Panasonic has already invested in a 5G capable ground network, another essential piece of a 5G capable end-to-end network. “Panasonic will continue to develop and scale its satellite capability to meet these growing bandwidth demands,” says Rogers. “That being said, I don’t expect the deployment of 5G on the ground, in itself, to have an immediate impact on capacity and throughput requirements in the airplane.”

Use-cases, services and appropriate technology will ultimately drive 5G rollout in the air. “It may be that we see the large demand for data off-load applications being an initial driver for 5G connectivity in this sector,” he says.

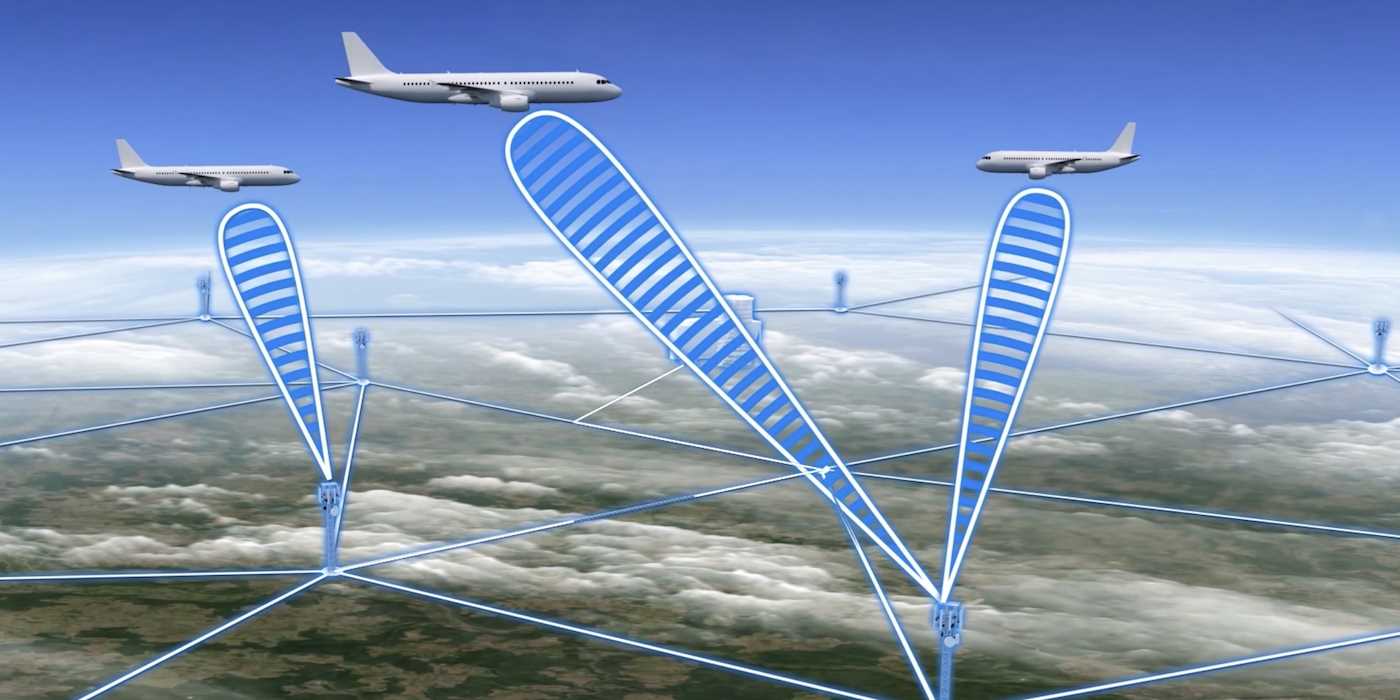

Both SITAONAIR and Panasonic are members of the ever-growing Seamless Air Alliance, which was specifically created “to enable passengers to use their connected devices in a seamless way” ensuring that they can connect without login or credit cards as enabled by their current mobile operators. In the alliance’s view, the 5G passenger experience of tomorrow requires standards that can be adopted industry-wide today.

Seamless, whose founding members include Airbus, Delta and Sprint, has formed a research lab, and published a ‘version 1’ specification document that covers network architecture, onboard radio access and authentication, definitions and requirements, roles and entities, and regulatory constraints. These areas have been identified as core building blocks for each of the working groups to address.

Now the alliance will decide its next set of goals. “5G, for example – what’s the next set of features and how do we pull it all into the architecture we’re developing. All of that will get solved in the next 30 days. The work that’s going on in the lab and in the group are really accelerating things pretty quickly,” Seamless CEO Jack Mandala tells RGN today from the Mobile World Congress in Barcelona.

Cre: Runway girl network